What is JIPF?

- Japan Investor Protection Fund ("JIPF") was established on December 1, 1998, as a nonprofit membership corporation under the Financial Instruments and Exchange Act.

- JIPF plays an important role as the final means of protection of securities firm customers.

- JIPF implements investor protection by providing compensation of up to \10 million per customer in cases where a securities firm cannot return the money and securities of customers because of bankruptcy or other financial difficulties.

- While JIPF is administered and managed as a private organization supported by member securities firms’ membership fees and levies, it is a corporation authorized by the prime minister and the minister of finance in accordance with the Financial Instruments and Exchange Act, regulated and supervised by the Financial Services Agency and the Ministry of Finance.

Separate management system

- Securities firms ensure the preservation of customer assets by managing them separately.

-

- Securities firms are required by law to manage the money, shares, bonds, and other securities entrusted by customers strictly separately from their own assets. This is called the separate management of customer assets.

- As long as separate management is thoroughly observed, even if a securities firm goes bankrupt, this will in principle have no effect on customer assets and customers can request return of their money and securities from the bankrupt securities firm.

- Assets which customers entrust to securities firms are protected by the dual systems of this separate management system and compensation by JIPF.

JIPF mission

- JIPF's mission is to protect investors and thereby maintain the reliability of securities transactions.

- JIPF's mission is to ensure the protection of investors and thereby maintain the reliability of securities transactions, through compensation payments to general customers with eligible claims against Securities firms and through other services.

Authorities of JIPF

- JIPF has two main authorities.

- First, JIPF has the authority to pay compensation after resolving to recognize the necessity of compensation and issue public notice in cases where a securities firm cannot return the money and securities of customers because of bankruptcy or other financial difficulties.

- Second, JIPF has the authority to manage an investor protection fund to implement compensation.

- The Financial Instruments and Exchange Act and other laws stipulate most of JIPF’s other authorities, which are primarily exercised (a) after receiving permission from the Financial Services Agency and the Ministry of Finance, (b) with the consent of the customers of members, (c) under prior consignment from member securities firms, or (d) by appointment or nomination to a particular position based on the provision of the Bankruptcy Act, the Deposit Insurance Act, and other laws. These, however, are not considered authorities that can be exercised independently by JIPF.

- As authorities which JIPF can exercise independently aside from the two main authorities stated above, JIPF may, when deemed necessary, demand that members submit reports and materials regarding the state of their business or property which serve as a reference, or have JIPF staff audit members firms.

Range of compensation

Customers eligible for compensation

Of the customers of JIPF member securities firms, those entitled to receive compensation from JIPF are general customers who are not "professional investors" that include financial institutions and other qualified institutional investors, as well as national and local governments.

Even customers who are otherwise eligible for compensation are excluded from compensation in the event of trading their assets in the name of others, using fictitious names or borrowed names.

The officers, parent companies, etc., of bankrupt securities firms are also excluded from compensation.

Transactions, etc., eligible for compensation

The money, securities, and other customer assets eligible for compensation are limited to those entrusted by customers concerning the securities-related business or the commodity derivatives-related business conducted by securities firms.

- The transactions eligible for compensation by JIPF include the following:

- Share transactions (including shares issued overseas)

- Public and corporate bonds transactions (including those bonds issued overseas)

- Investment trust transactions (including those trusts issued overseas)

- Deposits concerning margin transactions of shares

Note: The items eligible for compensation are margin deposits and securities deposited in lieu of margin deposits

- Clearing margins concerning securities futures transactions and securities options transactions on domestic exchanges

Example: Clearing margins and securities deposited in lieu of clearing margins for Nikkei 225 futures or Nikkei 225 options transactions on the Osaka Exchange

- Clearing margins concerning equity index margin transactions on domestic exchanges

Example: Clearing margins and securities deposited in lieu of clearing margins concerning exchange equity index margin contracts on the Tokyo Financial Exchange

- Of transactions handled by securities firms, those not eligible for compensation by JIPF include the following:

- Over-the-counter securities derivatives transactions (securities futures, options, and contract-for-difference [CFD] transactions that are conducted directly between the parties outside of exchange markets)

- Market securities derivatives transactions on overseas exchanges (securities futures, options, and CFD transactions conducted on overseas exchanges)

- On-exchange currency transactions (Click 365 transactions on the Tokyo Financial Exchange, etc.)

- Foreign exchange margin transactions (FX transactions)

- Transactions of financial instruments that fall under the Type II Financial Instruments Business, such as trust beneficial rights, or rights in partnership agreements, anonymous partnership agreements or investment limited partnership agreements.

- These transactions are excluded from compensation by JIPF, either in accordance with the provisions of the Financial Instruments and Exchange Act or for the reason that almost all the customers conducting these transactions are professional investors.

- Even for transactions eligible for compensation, shares and corporate bonds issued by a bankrupt securities firm are excluded from compensation.

Compensation procedure

- The steps of the compensation procedure are as follows:

-

- (1) Securities firms that are JIPF members must immediately notify JIPF in the event that their registration is revoked or that they file a petition for the commencement of bankruptcy proceedings (hereinafter, such member securities firms are referred to as "Notifying Members").

- (2) JIPF conducts an audit to confirm whether the Notifying Member preserves customers' money and securities by managing them separately from its own assets.

- A court issues a provisional administration order to prohibit the disposition of the Notifying Member's property and appoints a provisional administrator.

- JIPF receives a report from the provisional administrator regarding changes in the customer assets entrusted to the Notifying Member.

- (3) In cases where the Notifying Member is unable, or highly likely to be unable, to return the money and securities entrusted by customers, JIPF resolves to grant recognition, and issue public notice, of difficulty in payment.

- Customers submit documents requesting payment to JIPF in accordance with the period, location, method, and other particulars for requesting compensation stated in newspaper public notices or notices mailed to customers.

- (4) JIPF checks the customer documents requesting payment against the records of the Notifying Member, determines the amount to be paid by JIPF, and pays the compensation.

- Customers' money is calculated based on ledgers and documents.

- The value of customer's securities is measured at the closing price on the market on the day the public notice was made.

- The amount of compensation to be paid by JIPF also considers the amount obtained by deducting the customer's debt and collateral provided.

- JIPF pays a maximum compensation of ¥10 million per customer, and acquires the claim which was the subject of the compensation from the customer in accordance with the compensation payment amount.

- (5) The bankruptcy trustee initiates the liquidation proceedings of the Notifying Member in parallel with JIPF's compensation payment determination process.

- Customers requesting payments exceeding ¥10 million may be entitled to receive additional distributions.

- JIPF confirms the status of customer assets with the bankruptcy trustee, prepares a list of customers requesting payments exceeding ¥10 million, and submits this to the court.

Fund for investor protection ("Investor Protection Fund")

Balance of Investor Protection Fund

The balance of the Investor Protection Fund of JIPF was approximately ¥58.4 billion at the end of fiscal 2022.

Investment of Investor Protection Fund

The Investor Protection Fund can be invested only in the government bonds, bank deposits, and other instruments designated by the prime minister and the minister of finance.

Collection of levies for Investor Protection Fund

The amount deemed sufficient as necessary for investor protection activities is ¥50.0 billion under the provisions of the Regulations of Business.

When the balance of the Investor Protection Fund is less than ¥50.0 billion, member securities firms must pay the levies computed based on a basic calculation amount of ¥5.0 billion per year.

Because the balance of the Investor Protection Fund has been ¥50.0 billion or more, JIPF has not collected any levies since fiscal 2003.

When levies are collected, the levies are composed of a fixed amount and a variable amount.

The basic calculation amount is set at ¥5.0 billion per year under the Regulations of Business.

The levies of each member are the total of the following (A), (B), and (C):

- The amount derived by dividing a sum equal to 20% of the basic calculation amount by the number of members (A);

- The amount derived by multiplying a sum equal to 40% of the basic calculation amount by the ratio of each member’s operating revenue to the total operating revenue of all members (B); and

- The amount derived by multiplying a sum equal to 40% of the basic calculation amount by the ratio that is obtained by dividing the amount of customer assets eligible for compensation of each member by the total amount of the customer assets eligible for compensation of all members (C).

History

| 1968 | Entrusted Securities Indemnity Fund was established. |

| 1969 | Entrusted Securities Indemnity Fund becomes an incorporated foundation. |

| 1998 | Entrusted Securities Indemnity Fund reorganized into Japan Investor Protection Fund (JIPF) under the revised Securities and Exchange Act. |

| 2002 | JIPF and Securities Investor Protection Fund merge to become the present JIPF. |

| 2007 | The Securities and Exchange Act revised into the Financial Instruments and Exchange Act and put into force, under government policies focusing on the diversification,

fairness, and transparency of financial instruments and services. |

Background to the establishment of JIPF

The so-called bubble economy burst in the early 1990s, followed by harsh conditions in the Japanese economy with the bad debt problem, corporate bankruptcies, and long-term recession.

By 1998, two leading securities firms and three large financial institutions went bankrupt in Japan. The government eased regulations that had caused inefficiencies at banks, insurance companies, and securities firms, and advanced reforms toward free, fair, and global markets in the "financial big bang" from 1997 to around 2001.

In the securities field, a registration system was introduced to promote the entry of new firms, and the liberalization of the securities business was initiated. These measures, however, were expected to increase the possibility of securities firm discontinuances and bankruptcies. From the perspective of preventing unexpected customer damages, securities firms were therefore legally obliged to separately manage customer assets; and JIPF was established as a juridical person for the purpose of investor protection.

Organization

Members

- All securities firms are obliged to become members of JIPF.

- The members of JIPF (securities firms) are defined under the Financial Instruments and Exchange Act to the following effect:

- Entities eligible for membership in JIPF are limited to the Type I Financial Instruments Business Operators conducting securities-related business or commodity derivatives transaction-related business.

Members

Officers

- As its officers, JIPF has the chairman, two or more directors, and one or more auditors.

- Officers are appointed by resolution of General Meeting of members from among the Member Representative and individuals who have expertise and experience necessary for the proper operation of JIPF.

Member List of Board of Directors (As of April 1, 2024)

| Chairman | OKUBO Yoshio |

| Director | UEMURA Tatsuo

(Waseda University) |

| Director | KUSUNOKI Yuji

(Rakuten Securities, Inc.) |

| Director | KODAKA Fujio

(Musashi Securities Co., Ltd.) |

| Director | SAKURAI Hiroko

(Daiwa Securities Co., Ltd.) |

| Director | SHIMAMOTO Koji

(Societe Generale Securities Japan Limited) |

| Director | HARADA Kimie

(Chuo University) |

| Director | FUJISAWA Kumi

(Institute for International Socio-Economic Studies, Ltd.) |

| Director | MATSUO Motonobu

(Japan Securities Dealers Association) |

| Auditor | ARAKAWA Shinji

(Certified Public Accountant) |

| Auditor | KOBAYASHI Masahiro

(Meiwa Securities Co., Ltd.) |

| Senior Managing Director | SAKAI Tatsuhiro |

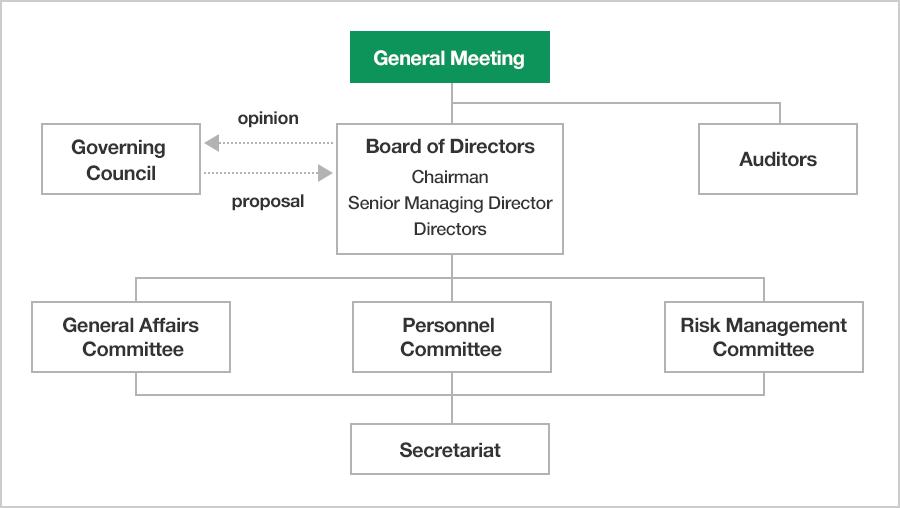

General Meeting

- The General Meeting is the highest organization that makes the decisions of JIPF.

- JIPF is required to report resolutions passed by the General Meeting to the prime minister and the minister of finance.

Board of Directors

- Board of Directors adopts resolutions regarding matters prescribed in the ARTICLES OF INCORPORATION and important matters for the operation of JIPF.

- The Board of Directors is composed of the chairman and of at least two and no more than 12 directors

Governing Council

- The Governing Council is tasked with granting recognition of difficulty in payment to customers in cases where a Notifying Member is unable, or highly likely to be unable, to return the money and securities entrusted by customers, and with making proposals to the chairman regarding the appropriate operation of JIPF.

- The Governing Council is composed of eight or fewer members.

Compensation record

- Since it was established on December 1, 1998, JIPF has paid compensation to customers in the following two cases:

-

- Minami Securities Co., Ltd. (head office: Gunma Prefecture) with a total compensation amount of approx. ¥3.5 billion* (fiscal 2000)

(*There was no ¥10 million compensation limit at that time); and

- Marudai Securities Co., Ltd. (head office: Tokyo) with a total compensation amount of approx. ¥172 million (fiscal 2012).

Additionally, JIPF’s predecessor, the voluntary association Entrusted Securities Indemnity Fund, had paid compensation to customers, which had all been completed. The association's entire assets and liabilities were taken over by JIPF.

Number of members and fund scale

Number of members (as of March 31 of each fiscal year)

| 2019 | 2020 | 2021 | 2022 | 2023 |

| 261 | 262 | 265 | 268 | 268 |

Fund scale (in million yen, as of March 31 of each fiscal year)

| 2019 | 2020 | 2021 | 2022 | 2023 |

| 58,276 | 58,359 | 58,392 | 58,420 | 58,436 |

Information on international relations, etc

Study Group on Securities Firm Bankruptcy Laws and on Investor Protection Fund Systems

Cooperative research with Japan Securities Research Institute

1. Themes

- First meeting May 21, 2014

- "Japan Investor Protection Fund: Current Conditions and Issues"

- Second meeting July 16, 2014

- "US Investor Protection Fund System: Legal System and Issues concerning Securities Firm Bankruptcy"

- Third meeting October 22, 2014

- "Investor Protection Mechanism in Germany"

- Fourth meeting December 10, 2014

- "Investor Protection Fund System in the UK"

- Fifth meeting March 4, 2015

- "Investor Protection Fund System in France"

- Sixth meeting April 22, 2015

- "EU Investor Compensation Schemes in Case of Securities Firm Bankruptcies"

- "Examinations of Draft Question Items for Overseas Field Studies"

- Seventh meeting June 24, 2015

- "Canada's Investor Protection System in Case of Bankruptcies of Securities and Other Firms"

- "Return of Customer Assets at Time of Securities Firm Bankruptcies, Etc.: Current Problems in Japan"

- "Question Items and Other Matters for Field Study in the UK"

- Eighth meeting September 30, 2015

- "Report of Field Study in the UK"

- "Question Items and Other Matters for Field Study in France"

- Ninth meeting February 10, 2016

- "Field Study in France and Pre-answer to the Question"

- "Recent situation of US Investor Protection Fund System"

- Tenth meeting April 27, 2016

- "Report of Field Study in France"

- "Question Items and Other Matters for Field Study in Germany"

- Eleventh meeting July 27, 2016

- "Report of Field Study in Germany"

- "Ireland's Investor Compensation schemes ~relationship with EU directive~"

- Twelfth meeting November 16, 2016

- "Survey report of Germany"

- Thirteenth meeting March 22, 2017

- "Survey report of UK, France and Germany"

- Fourteenth meeting June 28, 2017

- "Question Items and Other Matters for Field Study in US"

- "Schedule for Field Study in US"

- Fifteenth meeting October 18, 2017

- "Report of Field Study in US"

- "The FSA’s Approach to Introduce the TLAC Framework"

- Sixteenth meeting November 29, 2017

- "Report of Investor Protection Fund System in US"

- "Issues on Investor Protection Fund System"

- Seventeenth meeting January 31, 2018

- "Legal System and Issues Concerning Resolution and Compensation for Securities Firms"

- "International Trends in Legal System for Bankruptcy of Securities Firms after Lehman Shock"

- "Practical Issues and Future Challenges on Japan Investor Protection Fund"

- Eighteenth meeting April 11, 2018

- "Free Discussion based on the Report of the Previous Meeting"

- Nineteenth meeting November 2, 2018

- "Investor Protection System in the US"

- Twentieth meeting May 9, 2019

- "Overview of Canadian Investor Protection Fund and its Role in the Canadian Financial System"

- Twenty-first meeting August 1, 2019

- Summary of "Overseas Field Study Report on Investor Protection Fund System"

2. Overseas field studies

- (1) Scheduled for fiscal 2015

- UK (August 2015)

- France (January 2016)

- (2) Scheduled for fiscal 2016

- (3) Scheduled for fiscal 2017

- US (August to September 2017)

International conferences

International Compensation Fund Meeting

- (1) International Compensation Fund Meeting

Date: June 9, 2010

Location: Montreal, CANADA

- (2) International Compensation Fund Meeting

Date: April 19, 2011

Location: Cape Town, SOUTH AFRICA

- (3) International Compensation Fund Meeting

Date: May 15, 2012

Location: Beijing, CHINA

- (4) International Compensation Schemes Meeting

Date: September 21, 2013

Location: Rome, ITALY

- (5) International Securities Investor Protection Conference

Date: May 15-16, 2014

Location: Shanghai, CHINA

- (6) International Seminar- Investor Compensation Schemes

Date: June 19, 2015

Location: London, UK

- (7) International Investor Compensation Fund Meeting

Date: September 29, 2016

Location: Vilnius, LITHUANIA

- (8) International Securities Investor Protection Conference

Date: August 30-31, 2017

Location: Beijing, CHINA

- (9) International Meeting of Investor Protection Funds

Date: May 9, 2018

Location: Budapest, HUNGARY

- (10) International Meeting of Investor Protection Funds

Date: May 15, 2019

Location: Sydney, AUSTRALIA

- (11) Forum of International Investor Compensation Schemes

Date: May 26, 2023

Location: Budapest, HUNGARY

Procedure for Joining JIPF

The following shows the procedures to join the JIPF as a TypeI Financial Instruments Business Operator engaged in the securities-related business and/or commodity derivatives transaction-related business:

Step 1: Preliminary Consultation

- Please prepare in advance the draft application documents that are to be submitted on the day of application.

Step 2: Submission of Application for Admission (Date of Application for Admission = Date of Application for Registration)

- The date of application for admission must be identical to the date of application for registration to the administrative authority.

Step 3: Membership Examination, etc

- In principle, the membership examination is carried out through interviews to be held at the Administrative Office of the JIPF. Please have the representative (a must) and an officer(s), who can explain the business activities of your company and application documents, attend the interview.

- The Risk Management Committee will be held to deliberate on your membership application.

Step 4: Determination of Admission (Date of Admission = Date of Registration)

- Upon approval at the Committee above, the procedure at the JIPF is completed.

- The date of admission must be identical to the date of registration to the administrative authority.

- On the day of registration, please submit the Registration Report to the JIPF by email.

- The JIPF will then mail you the Notice of Admission and Bill for Levies, etc.

Admission fee, Levies, and Membership Fee

When joining the JIPF as a securities company, you will be required to pay the admission fee, levies, and membership fee.

*Details will be informed in your application process.

- Please pay the levies, etc. described above within one week from the date of admission (*due date negotiable in advance as required).

- Once you start your operations, please submit the Business Commencement Report to the JIPF by email.

This completes the procedure for admission.

Support Desk in English

Foreign securities companies can apply for the admission process in English instead of Japanese.

Please contact us at the following link.

ARTICLES OF INCORPORATION and REGULATIONS OF BUSINESS